Crafting a Solid Startup Financial Planning Strategy

With startup financial planning at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights. Financial planning is the backbone of any successful startup, guiding decisions and ensuring longevity in a competitive market.

Let's dive into the world of startup financial planning and uncover the secrets to sustainable growth and success.

Importance of Financial Planning for Startups

Financial planning is a critical aspect for startups as it helps in mapping out the financial journey of the business. It involves setting financial goals, creating a budget, and establishing strategies to achieve those goals. Without proper financial planning, startups may struggle to manage their resources effectively and make informed decisions.Effective financial planning can have a significant impact on the success of a startup.

It enables entrepreneurs to identify potential risks, allocate resources efficiently, and adapt to changing market conditions. By having a clear financial roadmap, startups can make better investment decisions, secure funding, and ultimately increase their chances of long-term sustainability and growth.

Impact of Poor Financial Planning

Poor financial planning can lead to the downfall of even the most promising startups. One example is the case of Webvan, an online grocery delivery service that went bankrupt in 2001. Despite raising over $800 million in funding, the company failed to manage its expenses and expand too quickly, resulting in massive losses and eventual closure.

This highlights the importance of prudent financial planning to avoid overspending and ensure financial stability in the long run.

Components of Startup Financial Planning

Financial planning for startups involves several key components that are crucial for the success and sustainability of the business. One of the most important aspects of startup financial planning is budgeting, which helps in setting financial goals and allocating resources effectively.

Another critical component is cash flow management, which ensures that the business has enough liquidity to cover its expenses and operate smoothly.

Importance of Budgeting

Budgeting plays a vital role in financial planning for startups as it helps in forecasting revenue, setting targets, and monitoring expenses. By creating a budget, startups can track their financial performance, identify areas of improvement, and make informed decisions to achieve their financial goals.

It also helps in prioritizing expenses, managing cash flow, and avoiding financial pitfalls.

- Setting financial goals and targets

- Allocating resources effectively

- Monitoring expenses and financial performance

- Identifying areas of improvement and making informed decisions

- Prioritizing expenses and managing cash flow

Budgeting is essential for startups to plan, control, and optimize their financial resources effectively.

Role of Cash Flow Management

Cash flow management is another crucial component of startup financial planning, as it involves monitoring the flow of cash in and out of the business. It helps in ensuring that the business has enough liquidity to cover its day-to-day expenses, pay off debts, and invest in growth opportunities.

By managing cash flow effectively, startups can avoid financial crises, maintain financial stability, and sustain long-term growth.

- Monitoring cash inflows and outflows

- Ensuring liquidity for day-to-day operations

- Paying off debts and investing in growth opportunities

- Avoiding financial crises and maintaining stability

- Sustaining long-term growth and profitability

Effective cash flow management is essential for startups to ensure financial stability and support sustainable growth.

Strategies for Financial Forecasting

Financial forecasting is crucial for startups to plan and manage their finances effectively. There are various methods and strategies that startups can use to forecast their financials, both in the short-term and long-term. Utilizing the right tools and software can also streamline the forecasting process and provide more accurate projections.

Different Methods for Forecasting Financials

Financial forecasting can be done using different methods such as:

- Historical Data Analysis: Looking at past financial data to predict future performance.

- Top-Down Approach: Starting with overall market data and breaking it down to forecast specific financials.

- Bottom-Up Approach: Creating forecasts based on individual components and aggregating them for a complete financial picture.

Short-term vs

. Long-term Financial Forecasting Strategies

Short-term financial forecasting focuses on immediate financial needs and typically covers a period of up to one year. Long-term financial forecasting, on the other hand, looks at the bigger picture and projects financial performance over multiple years. Startups need to balance both short-term and long-term forecasting to ensure financial stability and growth.

Tools and Software for Financial Forecasting

There are several tools and software available that can aid startups in financial forecasting, such as:

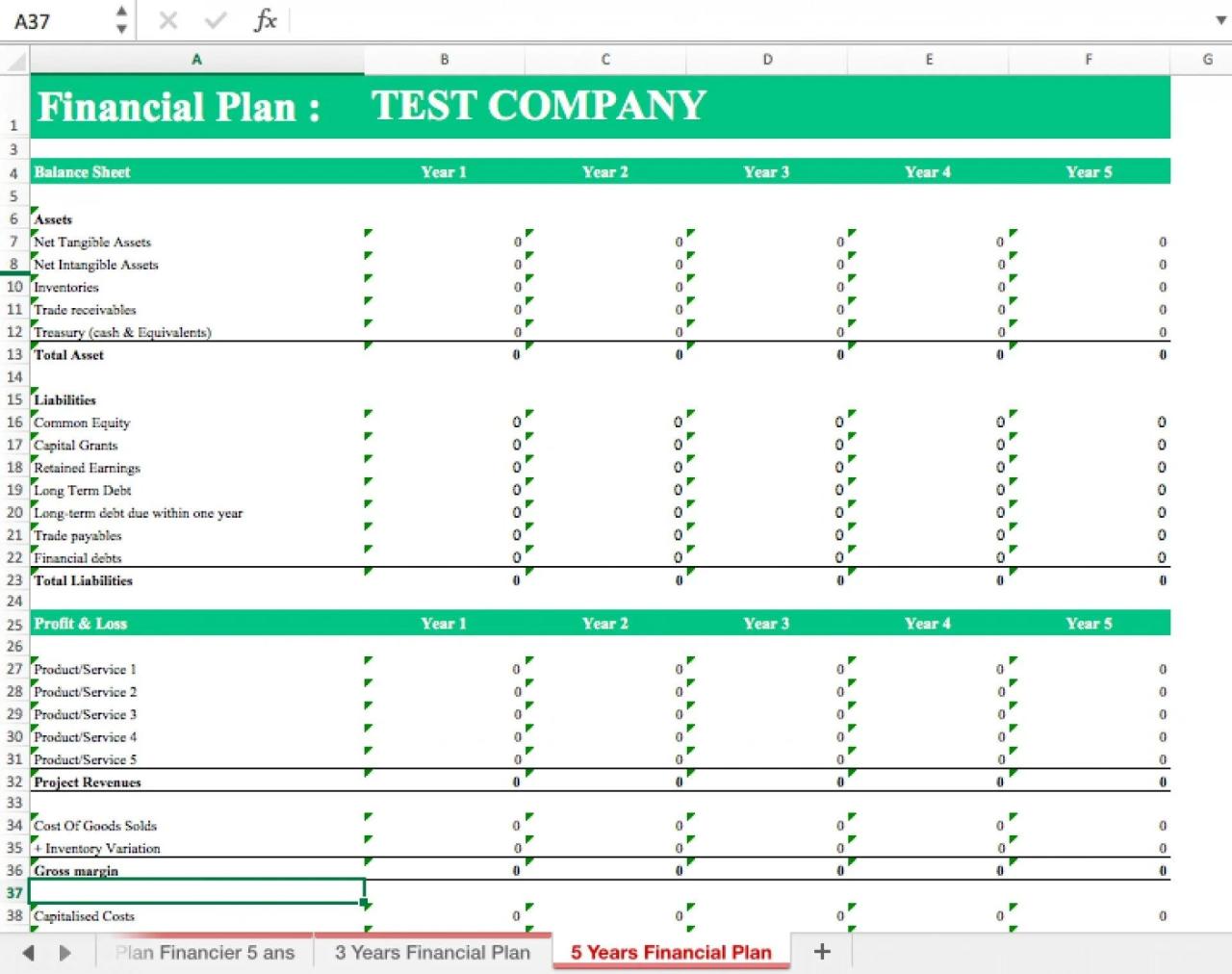

- Excel: Widely used for creating financial models and projections.

- QuickBooks: Helps in managing finances and generating financial reports.

- Forecasting Apps: Specialized apps like LivePlan or Float can assist in creating accurate financial forecasts.

Funding Options for Startups

Securing funding is crucial for the growth and success of startups. There are various sources of funding available to startups, each with its own pros and cons.

Bootstrapping vs. External Funding

Bootstrapping involves using personal savings or revenue generated by the business to fund its operations. While this allows the founders to maintain full control over the company and avoid debt, it can limit the growth potential due to limited resources.

On the other hand, seeking external funding from investors or lenders can provide the necessary capital to scale the business quickly, but it often involves giving up equity or incurring debt.

Venture Capital Funding

Venture capital funding is a popular option for startups looking to raise significant amounts of capital. The process typically involves pitching the business idea to venture capitalists, who are willing to invest in exchange for equity in the company. Venture capital firms often provide not just funding but also valuable expertise and connections to help the startup grow.

However, securing venture capital funding can be highly competitive and time-consuming, requiring a solid business plan and a strong pitch.

Risk Management in Startup Financial Planning

In the volatile world of startups, managing financial risks is crucial for long-term success. By identifying potential risks early on and implementing strategies to mitigate them, startups can increase their chances of survival and growth. A solid risk management plan should be an integral part of the overall financial planning process to ensure the sustainability of the business.

Common Financial Risks Faced by Startups

- Lack of cash flow: Startups often struggle with maintaining a positive cash flow, which can lead to financial instability.

- Market volatility: Changes in market conditions or unexpected competition can impact a startup's revenue and profitability.

- Dependency on key personnel: Startups may rely heavily on a few key individuals, whose sudden departure can disrupt operations.

- Regulatory challenges: Non-compliance with regulations can result in hefty fines and legal consequences for startups.

Strategies for Mitigating Financial Risks in the Early Stages of a Startup

- Diversification of revenue streams: By expanding into multiple markets or product lines, startups can reduce their dependence on a single source of income.

- Building a strong financial cushion: Setting aside emergency funds can help startups weather unexpected financial challenges.

- Implementing strict budgeting and monitoring: Regularly tracking expenses and revenues can help startups identify potential financial risks early on.

- Insurance coverage: Obtaining insurance policies to cover risks such as liability, property damage, or business interruption can protect startups from financial losses.

Importance of Having a Risk Management Plan

A risk management plan is essential for startups to proactively address potential threats to their financial stability. By identifying, assessing, and mitigating risks, startups can protect their assets, reputation, and long-term viability. A well-thought-out risk management plan can also instill confidence in investors and stakeholders, demonstrating that the startup is prepared for unforeseen challenges in the competitive business landscape.

Epilogue

As we conclude our exploration of startup financial planning, it becomes clear that meticulous planning and strategic decision-making are essential for the prosperity of any new venture. By understanding the importance of financial forecasting, budgeting, funding options, and risk management, startups can navigate the turbulent waters of entrepreneurship with confidence and resilience.

Embrace the power of financial planning and pave the way for a prosperous future for your startup.

FAQ Compilation

What are the key components of a startup financial plan?

The key components include revenue projections, expense forecasts, cash flow analysis, and financial goal setting.

What are some common sources of funding for startups?

Startups can secure funding through angel investors, venture capital firms, crowdfunding platforms, or traditional bank loans.

How can startups mitigate financial risks?

Startups can mitigate financial risks by diversifying revenue streams, creating emergency funds, and conducting regular financial audits.