Raising Funds for a Startup: A Comprehensive Guide

Embark on a journey into the world of raising funds for a startup with this comprehensive guide. From exploring different funding options to mastering the art of pitching to investors, this topic covers key aspects essential for startup success. Whether you're a seasoned entrepreneur or a budding innovator, this guide offers valuable insights to navigate the challenging terrain of fundraising.

The following paragraphs delve into the intricacies of financial planning, networking strategies, and expert tips on crafting a compelling pitch to captivate potential investors.

Researching Funding Options

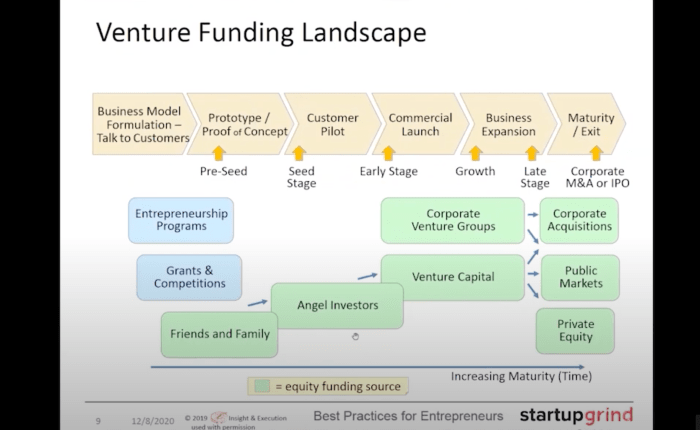

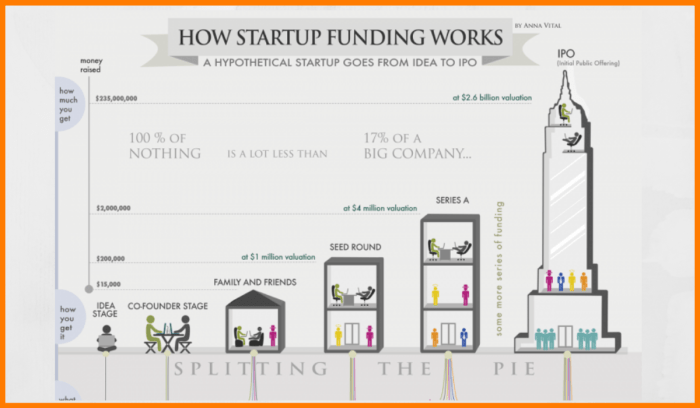

When it comes to funding a startup, there are various options available for entrepreneurs to explore. Each funding source comes with its own set of pros and cons, which must be carefully considered before making a decision. From bootstrapping to angel investors, venture capital, and even newer trends like ICOs and STOs, the choice of funding can significantly impact the trajectory of a startup.

Bootstrapping

Bootstrapping involves funding a startup with personal savings or revenue generated by the business itself. While this method allows founders to maintain full control over their company and avoid debt, it may limit the growth potential due to limited resources.

Loans

Taking out a loan is a common way for startups to secure funding. However, the downside is the obligation to repay the borrowed amount with interest, which can be a burden on the business, especially in the early stages.

Angel Investors

Angel investors are individuals who provide capital in exchange for equity in the startup. They can offer valuable expertise and connections, but founders may have to relinquish some control and decision-making power.

Venture Capital

Venture capital firms invest in startups with high growth potential in exchange for equity. While this funding source can provide substantial capital and strategic guidance, it often involves giving up a significant portion of ownership and control.

Crowdfunding

Crowdfunding platforms allow startups to raise funds from a large group of people, often in exchange for rewards or early access to products. This method can help validate the market demand for a product or service, but it requires a strong marketing strategy to attract backers.

ICOs and STOs

Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) are newer funding methods that involve issuing tokens or digital assets to investors. While these methods can provide access to a global pool of investors and liquidity, they also come with regulatory challenges and risks of fraud.

Creating a Compelling Pitch

Crafting a successful startup pitch is crucial in attracting investors and securing funding for your business. A compelling pitch should effectively communicate your business idea, the problem it solves, and the potential for growth and profitability. Here are some essential components and tips to consider when creating your pitch:

Essential Components of a Startup Pitch

- Clear and Concise Explanation of the Problem: Clearly define the problem or need that your product or service addresses.

- Solution Presentation: Present your solution in a simple and understandable way, showcasing how it effectively addresses the identified problem.

- Market Analysis: Provide data and insights on the target market, including size, trends, and competition.

- Business Model: Explain how your business will generate revenue and sustain growth over time.

- Financial Projections: Present realistic financial projections that demonstrate the potential return on investment for investors.

Crafting a Compelling Narrative

When crafting your pitch, it's essential to tell a compelling story that resonates with investors. Here are some tips:

- Start with a Strong Hook: Capture the attention of your audience from the beginning with a powerful opening statement or statistic.

- Show Your Passion: Demonstrate your passion and commitment to your business idea to inspire confidence in investors.

- Use Visuals: Incorporate visuals such as graphs, charts, and product demos to enhance understanding and engagement.

- Highlight Milestones: Showcase key milestones achieved and milestones to come to build credibility and trust.

Importance of a Strong Value Proposition and Unique Selling Points

In a competitive market, having a strong value proposition and unique selling points is essential to stand out and attract investors. Your value proposition should clearly communicate the benefits of your product or service to customers, while your unique selling points differentiate you from competitors.

When pitching to investors, emphasize how your value proposition addresses a significant market need and why your unique selling points give you a competitive edge.

Building a Strong Network

Building a strong network is crucial for startup founders looking to raise funds. By connecting with potential investors, leveraging social media, and participating in industry events, you can increase your chances of securing the funding needed to grow your business.

Strategies for Networking with Potential Investors

- Attend networking events: Participate in industry conferences, startup pitch competitions, and networking mixers to meet potential investors face-to-face.

- Utilize online platforms: Join investor networks on platforms like AngelList, LinkedIn, and Crunchbase to connect with investors interested in your industry.

- Ask for referrals: Reach out to your existing network for introductions to potential investors who may be interested in your startup.

Tips on Leveraging Social Media and Industry Events

- Engage with investors on social media: Follow and interact with investors on platforms like Twitter and LinkedIn to build relationships and stay updated on their interests.

- Share your progress: Use social media to share updates about your startup's milestones, partnerships, and achievements to attract investor attention.

- Attend industry events: Participate in industry conferences, demo days, and startup accelerators to showcase your startup and network with potential investors.

Significance of Mentorship and Advisory Boards

- Seek mentorship: Connect with experienced entrepreneurs, industry experts, and investors who can provide guidance, advice, and introductions to potential investors.

- Form an advisory board: Build an advisory board comprising individuals with diverse expertise who can offer strategic advice, industry insights, and connections to investors.

- Benefit from credibility: Having respected mentors and advisors on board can enhance your startup's credibility and attract investor interest.

Financial Planning and Forecasting

Financial planning is a crucial aspect of running a startup, as it helps in setting clear financial goals, managing cash flow effectively, and making informed decisions. When it comes to fundraising, accurate financial projections and forecasts play a vital role in attracting potential investors and securing the necessary funding.

Importance of Accurate Financial Planning

Accurate financial planning provides a roadmap for the startup, outlining expected revenues, expenses, and profits over a specific period. It helps in identifying potential risks and opportunities, enabling the management team to make strategic decisions to ensure the financial health of the business.

Creating Financial Projections and Forecasts

When creating financial projections for fundraising purposes, it is essential to consider factors such as market trends, competition, target audience, and growth potential. Start by estimating revenues based on sales forecasts, pricing strategies, and market demand. Then, project expenses by considering costs related to production, marketing, operations, and overhead.

Finally, calculate profits by subtracting expenses from revenues to determine the net income.

Key Financial Metrics Investors Look For

- Revenue Growth: Investors are interested in startups that demonstrate a consistent and scalable revenue growth trajectory.

- Gross Margin: A healthy gross margin indicates the startup's ability to generate profits after covering direct costs.

- Burn Rate: Investors assess the startup's burn rate to understand how quickly the company is spending its capital.

- Customer Acquisition Cost (CAC): CAC helps investors gauge the efficiency of the startup's marketing and sales efforts in acquiring new customers.

- Lifetime Value (LTV) to CAC Ratio: A high LTV to CAC ratio indicates that the startup can generate significant returns from each customer acquired.

Pitching to Investors

Preparing and delivering a pitch to potential investors is a critical step in securing funding for your startup. It involves crafting a compelling presentation that effectively communicates your business idea, market opportunity, and financial projections. Here are some best practices to keep in mind for pitching sessions and tailoring your pitch to different types of investors.

Best Practices for Pitching Sessions

- Begin with a strong and engaging opening to grab investors' attention from the start.

- Clearly articulate your value proposition and what sets your startup apart from competitors.

- Use visuals and storytelling to make your presentation memorable and easy to understand.

- Practice your pitch multiple times to ensure you can deliver it confidently and concisely.

- Be prepared to answer questions thoughtfully and demonstrate your knowledge of the market and industry.

Tailoring Pitches for Different Types of Investors

- For angel investors, focus on the passion and vision behind your startup, as they often invest based on personal connections and beliefs.

- With venture capitalists (VCs), emphasize the scalability and potential for high returns on investment to align with their growth-focused criteria.

- Consider the specific interests and investment criteria of each investor you are pitching to and tailor your presentation accordingly.

- Highlight how their investment will help fuel the growth of your startup and generate a significant return on their investment.

Ultimate Conclusion

In conclusion, the journey of raising funds for a startup is a dynamic and rewarding process that requires strategic planning and effective communication. By implementing the strategies Artikeld in this guide, entrepreneurs can enhance their fundraising efforts and increase the likelihood of securing vital investment for their ventures.

Questions and Answers

What are the key differences between ICOs and traditional funding methods?

ICOs involve the issuance of digital tokens in exchange for investment, whereas traditional methods like loans and venture capital involve more regulated financial transactions.

How important is having a strong network in fundraising for a startup?

Building a strong network is crucial as it can provide valuable connections to potential investors, mentors, and industry experts who can support and guide the startup.

What financial metrics do investors typically look for in a startup?

Investors often focus on metrics such as revenue growth, profit margins, customer acquisition costs, and overall scalability of the business.