Exploring the World of Startup Investors

Dive into the realm of startup investors where opportunities and risks intersect to shape the future of budding businesses. This introduction sets the stage for a comprehensive exploration of the pivotal role investors play in fostering innovation and growth in the entrepreneurial landscape.

Unveiling the intricacies of startup investors, this discussion sheds light on the diverse types, strategies for attracting them, and the dynamic benefits and challenges that come with their involvement.

Overview of Startup Investors

Startup investors play a crucial role in the entrepreneurial ecosystem by providing funding and support to early-stage companies. These investors can help startups grow and scale their businesses through financial backing, mentorship, and valuable connections.

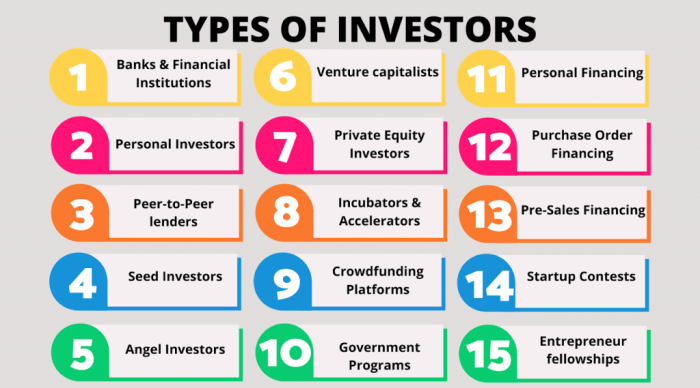

Types of Startup Investors

- Angel Investors: Individuals who invest their own money in startups in exchange for equity.

- Venture Capitalists: Professional investment firms that manage funds from various sources to invest in high-growth startups.

- Corporate Investors: Companies that invest in startups to gain strategic advantages or access to innovative technologies.

- Crowdfunding Platforms: Online platforms that allow a large number of individuals to invest small amounts of money in startups.

Contribution to Startup Growth

Startup investors contribute to the growth of early-stage companies by providing not only financial resources but also expertise and guidance. They help startups navigate challenges, make strategic decisions, and access valuable networks that can accelerate their growth. Additionally, investors can open doors to new opportunities, partnerships, and potential customers, allowing startups to reach their full potential.

Characteristics of Startup Investors

Successful startup investors possess several key traits that set them apart in the investment world. These characteristics play a vital role in their ability to navigate the dynamic and high-risk environment of startup investing.

Risk Tolerance Levels

Startup investors are known for their high risk tolerance levels, as they understand that investing in early-stage companies comes with a significant amount of uncertainty. They are willing to take calculated risks and understand that not all investments will yield positive returns.

This risk appetite allows them to explore innovative ideas and support entrepreneurs in building disruptive businesses.

Industry Knowledge

Having a deep understanding of the industry in which they are investing is crucial for startup investors. This knowledge helps them identify emerging trends, assess market opportunities, and evaluate the potential success of a startup. By staying informed about the latest developments and technologies, investors can make informed decisions that increase their chances of backing successful ventures.

Strategies for Attracting Startup Investors

To attract startup investors, entrepreneurs need to be well-prepared and strategic in their approach. From crafting a compelling pitch to building a strong network and conducting thorough research, there are several key strategies that can increase the chances of attracting investors to your startup.

Crafting a Compelling Pitch

When preparing a pitch for investors, entrepreneurs should focus on clearly communicating the problem their startup solves, the market opportunity, their unique value proposition, and the potential for growth. It's essential to present a well-thought-out business plan, financial projections, and a strong team that can execute the vision effectively.

Building a Strong Network

Networking plays a crucial role in attracting startup investors

Conducting Thorough Research

Before approaching investors, it's important to conduct thorough research to understand their investment criteria, portfolio companies, and past investments. Entrepreneurs should tailor their pitch and approach based on the investor's preferences and interests. Utilizing online platforms, networking events, and referrals can help identify potential investors who align with the startup's goals and vision.

Benefits and Challenges of Working with Startup Investors

Startup investors can bring a wealth of benefits to entrepreneurs, helping them achieve growth and success. However, working with startup investors also comes with its own set of challenges that entrepreneurs need to navigate.

Advantages of Having Startup Investors

Having startup investors on board can provide the following advantages:

- Access to capital to fuel growth and expansion

- Expertise and guidance from experienced investors

- Networking opportunities with other industry professionals

- Credibility and validation for the startup

- Potential for increased visibility and market reach

Common Challenges Faced by Entrepreneurs

Entrepreneurs often encounter the following challenges when working with startup investors:

- Lack of autonomy and decision-making power

- Differing priorities and visions between investors and entrepreneurs

- Pressure to meet investor expectations and deliver results

- Potential conflicts of interest or disagreements during decision-making processes

- Risk of losing control over the direction of the startup

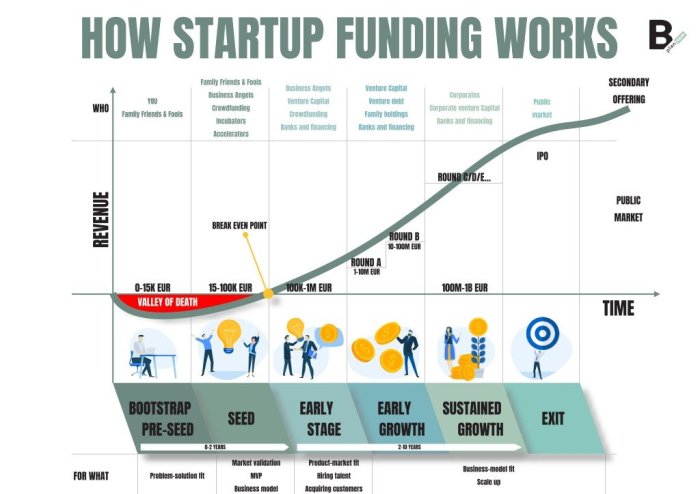

Comparing Funding Options for Startups

Beyond traditional startup investors, startups can explore other funding options such as:

- Crowdfunding platforms for raising capital from a large pool of individual investors

- Angel investors who provide financial support and mentorship to startups

- Venture capital firms that invest in high-growth potential startups in exchange for equity

- Bootstrapping by using personal savings or revenue to fund the startup

- Government grants and loans for startups in specific industries or regions

Closing Notes

In conclusion, the journey through the realm of startup investors unveils a tapestry of possibilities and hurdles, highlighting the essence of strategic partnerships in fueling entrepreneurial success. As the entrepreneurial ecosystem evolves, the synergy between startups and investors continues to drive innovation and reshape industries, propelling towards a future ripe with potential and promise.

FAQ Compilation

What are the key traits successful startup investors possess?

Successful startup investors often exhibit traits such as risk-taking ability, strategic vision, industry expertise, and a strong network.

How can entrepreneurs prepare a compelling pitch for startup investors?

Entrepreneurs can prepare a compelling pitch by clearly articulating their business idea, showcasing market potential, demonstrating traction, and highlighting the team's capabilities.

What are some common challenges faced by entrepreneurs when working with startup investors?

Common challenges include maintaining alignment on strategic direction, managing expectations, and navigating decision-making processes.