Title: Mastering Startup Risk Management for Long-Term Success

Delving into startup risk management, this introduction immerses readers in a unique and compelling narrative. Understanding the importance of effectively managing risks is key for the longevity of any new business. From identifying potential risks to implementing mitigation strategies, startup risk management plays a pivotal role in shaping the success of entrepreneurial ventures.

Introduction to Startup Risk Management

Startup risk management involves identifying, assessing, and mitigating potential risks that new businesses may face during their early stages of operation. It is a crucial process that helps startups navigate uncertainties and challenges effectively, ultimately increasing their chances of success.One of the main reasons why startup risk management is essential is that new businesses often operate in a highly volatile and competitive environment.

Without proper risk management strategies in place, startups are more vulnerable to unexpected events that could derail their progress or even lead to failure.Some common risks that startups commonly face include financial risks such as cash flow problems, market risks like changes in consumer demand, operational risks such as supply chain disruptions, and strategic risks like fierce competition or technological changes.

By proactively addressing these risks through effective risk management practices, startups can minimize the impact of potential threats and maximize their chances of achieving long-term sustainability and growth.

Identifying Risks

Identifying risks is a crucial step in risk management for startups as it allows them to proactively address potential threats to their business operations. By recognizing and understanding the different types of risks, startups can implement strategies to mitigate their impact and increase their chances of success.

Methods for Identifying Potential Risks

One method for identifying potential risks in a startup is conducting a thorough risk assessment. This involves examining all aspects of the business, including internal processes, external factors, and market conditions, to identify any potential threats. Startups can also utilize tools such as SWOT analysis, scenario planning, and risk registers to systematically identify and categorize risks.

Internal vs. External Risks

Internal risks are factors that originate within the startup itself, such as operational inefficiencies, financial mismanagement, or lack of skilled personnel. On the other hand, external risks are external factors that are beyond the startup's control, such as changes in market trends, regulatory changes, or economic downturns.

While internal risks can be mitigated through proper management and planning, external risks require startups to adapt and respond to external changes effectively.

Real-Life Examples of Startup Failures due to Poor Risk Identification

One notable example of a startup failure due to poor risk identification is the case of Blockbuster. Blockbuster failed to adapt to the shift towards online streaming and underestimated the threat posed by competitors like Netflix. As a result, Blockbuster filed for bankruptcy in 2010, highlighting the importance of identifying and addressing risks in a timely manner to avoid business failures.

Risk Assessment and Prioritization

Risk assessment and prioritization are crucial steps in managing risks effectively within a startup. By identifying, analyzing, and prioritizing risks, a startup can allocate resources efficiently and focus on mitigating the most critical threats to its success.

Process of Risk Assessment and Prioritization

Risk assessment involves identifying potential risks that could impact the startup's objectives, evaluating the likelihood and impact of each risk, and determining how to respond to them. Once the risks are identified, prioritization comes into play by assessing the significance of each risk and ranking them based on their potential impact on the startup's goals.

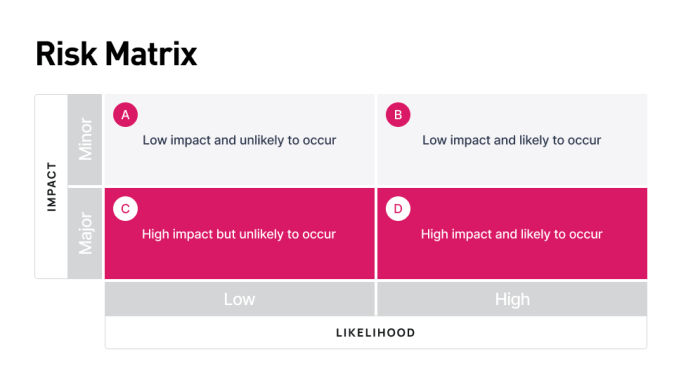

- Utilize risk assessment frameworks such as the Risk Matrix to categorize risks based on their likelihood and impact levels.

- Conduct a SWOT analysis to identify internal strengths and weaknesses that could pose risks, along with external opportunities and threats.

- Perform a Failure Mode and Effects Analysis (FMEA) to evaluate potential failure modes of processes and prioritize risks accordingly.

Effective risk assessment and prioritization allow startups to focus their resources on addressing the most critical risks, minimizing potential threats to their success.

Case Study: Effective Risk Prioritization

In a tech startup developing a new mobile app, the team conducted a thorough risk assessment and prioritization process before launch. By identifying security vulnerabilities as high-impact risks, they focused on implementing robust security measures to protect user data. This proactive approach not only safeguarded the app from potential cyber threats but also enhanced user trust and satisfaction, leading to the app's successful launch and widespread adoption.

Risk Mitigation Strategies

Implementing effective risk mitigation strategies is crucial for the success and sustainability of a startup. By proactively addressing potential risks, startups can minimize the impact of uncertainties and increase their chances of achieving their goals.

Risk Diversification

One key strategy for mitigating risks in a startup is diversification. By diversifying the business model, target markets, products or services, and revenue streams, startups can spread out risks and reduce the impact of any single point of failure. This approach helps in safeguarding the business against unforeseen events affecting specific areas.

Insurance Coverage

Another important risk mitigation strategy is obtaining insurance coverage. Startups can protect themselves from financial losses due to various risks such as property damage, liability claims, or business interruptions by having the appropriate insurance policies in place. This provides a safety net in case of unexpected events.

Partnership and Collaboration

Collaborating with established companies or forming strategic partnerships can also help startups mitigate risks. By leveraging the expertise, resources, and networks of partners, startups can access additional support and guidance to navigate potential challenges effectively. This can also open up new opportunities for growth and expansion.

Contingency Planning

Having a well-defined contingency plan is essential for startups to address unforeseen risks. By identifying potential risks in advance and developing contingency measures, startups can respond swiftly and effectively when disruptions occur. This proactive approach can help minimize the impact of unexpected events and ensure business continuity.

Monitoring and Review

Continuous monitoring and review of risks are crucial for the success and sustainability of a startup. By regularly assessing potential risks, a startup can proactively identify threats and take necessary actions to mitigate them before they escalate into larger problems.

Importance of Ongoing Monitoring

Ongoing monitoring allows a startup to stay abreast of any changes in the business environment that may pose new risks. It provides an opportunity to evaluate the effectiveness of existing risk management strategies and adjust them accordingly. Without regular monitoring, a startup may overlook emerging risks, leading to unforeseen consequences.

Key Performance Indicators (KPIs)

- Number of identified risks: Tracking the number of risks identified over time can indicate the thoroughness of the risk assessment process.

- Risk response time: Monitoring how quickly risks are addressed can showcase the startup's agility in handling potential threats.

- Impact on business operations: Assessing the impact of risks on daily operations can help prioritize risk mitigation efforts.

- Compliance with risk management policies: Ensuring adherence to established risk management protocols is vital for effective risk mitigation.

Scenario of Regular Monitoring

In a startup focused on e-commerce, regular monitoring of cybersecurity risks revealed a potential vulnerability in the payment processing system. By addressing this issue promptly, the startup was able to prevent a data breach that could have resulted in significant financial losses and damage to the company's reputation.

Final Wrap-Up

In conclusion, startup risk management is not just about avoiding pitfalls but also about seizing opportunities. By carefully assessing, prioritizing, and mitigating risks, startups can position themselves for sustainable growth and resilience in a competitive market landscape. Embracing a proactive approach towards risk management is essential for navigating the unpredictable journey of entrepreneurship.

FAQ Summary

What are some common risks that startups face?

Startups often face risks such as market competition, financial constraints, regulatory challenges, and team dynamics.

How can startups identify potential risks?

Startups can identify risks through SWOT analysis, market research, competitor analysis, and feedback from stakeholders.

Why is risk assessment crucial for startups?

Risk assessment helps startups understand potential threats, prioritize actions, and allocate resources effectively to mitigate risks.

What are some effective risk mitigation strategies for startups?

Effective risk mitigation strategies for startups include diversification, insurance coverage, contingency planning, and regular performance monitoring.

How can startups ensure ongoing monitoring of risks?

Startups can ensure ongoing monitoring of risks by setting up key performance indicators (KPIs), conducting regular risk assessments, and fostering a culture of risk awareness within the organization.